In 2020, more than 1.2 million electric cars and plug-in

hybrids were sold – around a 15% increase on the previous year. According to a

recent report by the Center of Automotive Management (CAM), China is

increasingly becoming the mainstay customer of the transforming automotive

industry. The Electromobility Report 2021, by industry news outlet

electrive.net, also says »China is not only the largest global car market,

which [...] has recovered best from the coronavirus crisis. The country is also

the most important market for electric cars, enabling new players to enter the

premier league of global car manufacturers. Above all, the domestic players are

showing enormous flexibility and dynamism with new future-focused topics.« In

Europe too, the turnover from plug-in hybrids and fully electric cars is

growing rapidly compared to the downward trend of the market overall. Norway is

in pole position, where 87% of all new vehicle approvals in December 2020 were

plug-ins. The regulatory requirements on pollutants and sinking battery costs

are helping drive the development of the e-mobility sector.

Less air traffic,

smaller vehicles

China is also seeing growth in the aviation sector. The

country now has over 50 international airports and an additional 150 for

domestic travel. The large state airlines significantly built up their fleets

in 2020; the five-year plan announced at the 13th National People’s Congress,

particularly demanded development and construction of jet engines. The development across the rest of the world is more

complex. In 2020, consultancy firm Roland Berger drew up three different scenarios

on the effects of the COVID-19 pandemic and the further development of the

global aviation industry by 2030.

Scenario 1: A quick recovery by winter 2020.

Scenario 2: Delayed Cure with a 27% reduced demand until 2030 and the lower air

traffic density effecting the product mix. In the future, smaller models will

be most in demand, to make flying on certain routes profitable even with lower

passenger numbers. Scenario 3 – which is now the most likely – is a

significantly recessive development. This would include the »new normal«, a low

level in summer 2022, and a 50% reduction in demand. This »new normal« also

presents a challenge for suppliers. Operational processes have to be reduced

further and designed to be more efficient. The aviation industry also requires

innovative solutions to halve the CO2 output, as planned, by 2050. The

solutions may be in new drive technologies.

With

this backdrop – rapid growth in e-mobility and changed market conditions in

aviation – the highly productive machining of large components is gaining

significance for both sectors.

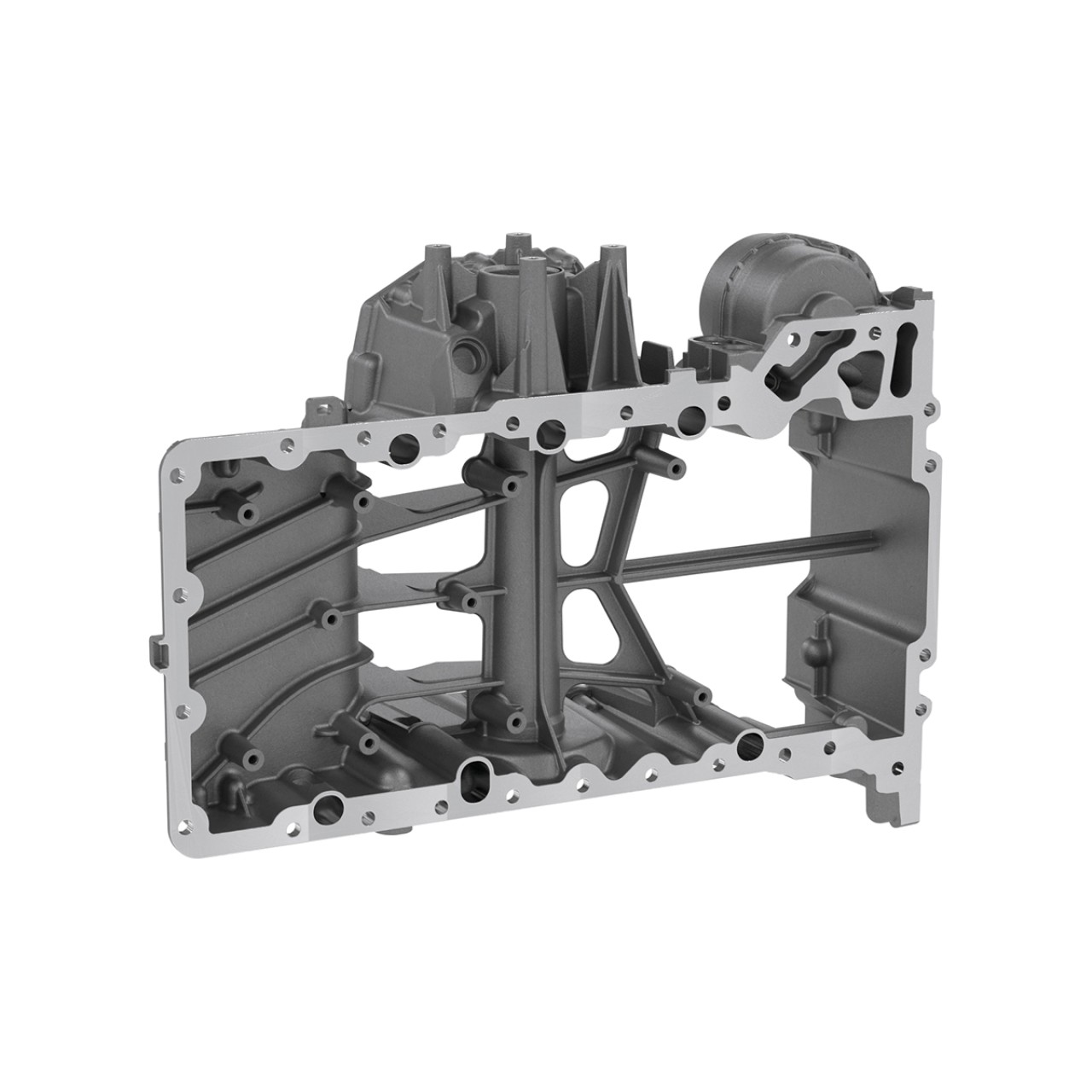

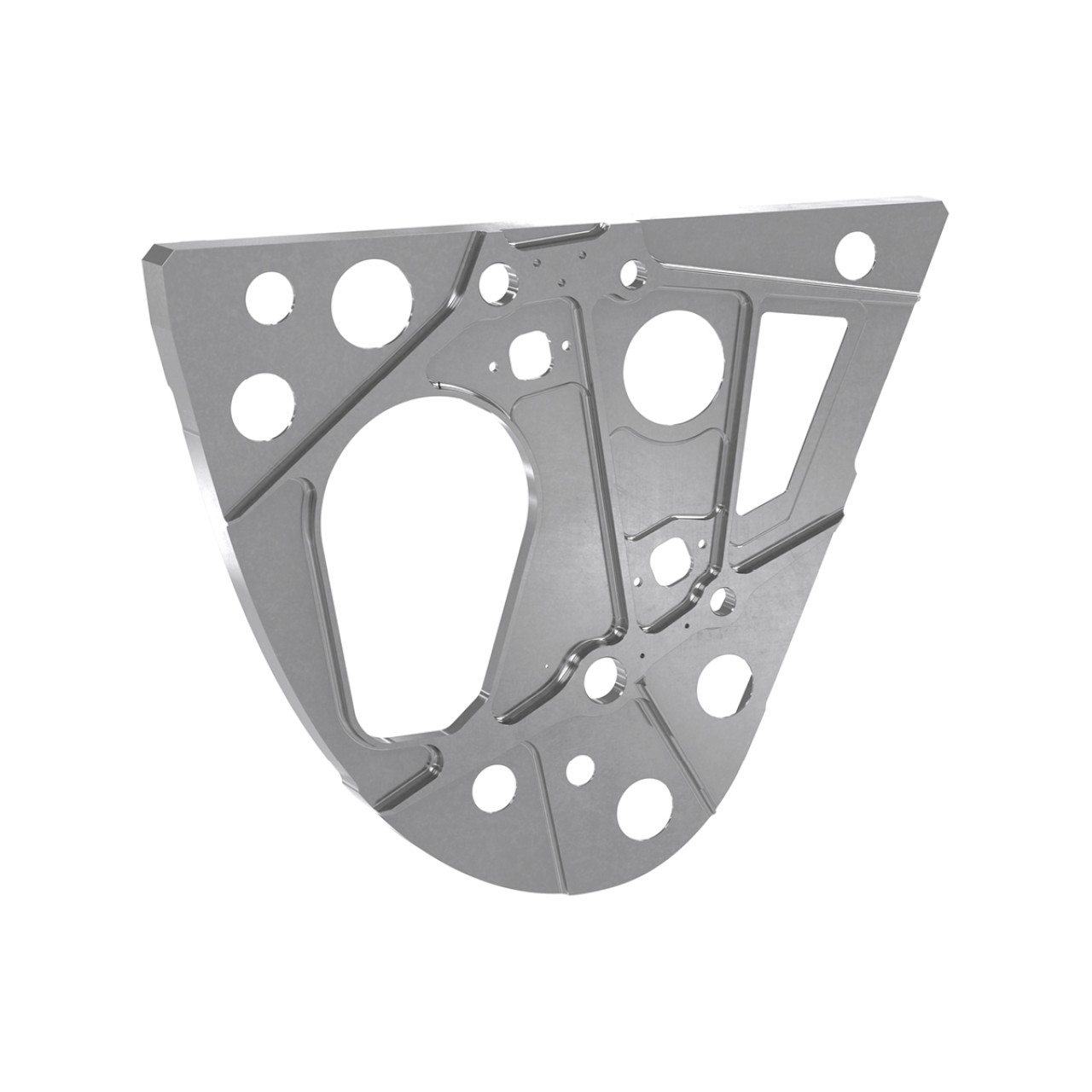

Automotive

Engine mounts

Main chassis beam

Large, larger

at the largest: Two spindles for maximum productivity

600, 800, 1,200 mm: With their graduated spindle clearance,

the three series are precisely designed for the various workpiece dimensions

and cover the whole range of

sizes and complex components for automotive and aerospace applications.

The common denominators for the double-spindle machining

centers include: Significantly shorter cycle times, optimum component quality,

high level of flexibility and a portable-sized rigid machine board for the

required precision. The large magazines ensure the productive machining of

demanding workpieces or product series, and the loading and unloading takes

place during regular operation. All machining centers can be configured to

customer requirements, and a coolant system or chip conveyor (and more) can be

added depending on the use. For increased utilization, the system can be

expanded to be fully automated. All series are ready to integrate the SmartLine digital systems for

optimized processes at the machine, in the environment, and in your company.

Process

advantages

Double-spindle, highly productive machining of large

components

Rigid machine base with a gantry or mobile gantry

construction ensures high precision

Process easily visible thanks to separation of the

operating and loading sides

Lots of tool options for versatile machining

Tool change during main operation

Independent tool change for each spindle for short

chip-to-chip times

Compact, flexible machine layout

Intuitive operation via TouchLine

Easy automation via robots or gantry

With the DZ 22 W five axis with a spindle

clearance of 600 millimeters, two different main spindles can be used depending

on the task at hand. The quicker spindle with an RPM up to 20,000 min-1and a torque of up to 110 Nm is ideal for aluminum or aluminum-alloy

workpieces. The stronger spindle with up to 12,500 min-1 RPM and a

torque of up to 200 Nm is best for hard materials and large tools. High axle

acceleration and efficient rapid traverse ensure the required dynamism. The 22 Series is available with two drives: A ball screw drive or a linear direct drive.

You can also choose from two plate variants: A suspension plate for four-axis

machining or two face plates for five-axis simultaneous machining.

CHIRON DZ 22 W five axis I High-performance milling

The spindles on the DZ 25,

with a spindle clearance of 800 mm, and the DZ 28 with 1,200-mm spindle clearance, can traverse

independently in X or Y direction – this makes it easy to offset inaccuracies

in tool pre-settings and with the clamping devices. Operating and loading take

place on separate sides with

easy access to the working area, and the same is true for the DZ 25 P five axis

and DZ 28 P five axis versions with pallet changer for high piece turnover and

short cycle times.

CHIRON DZ 25 P five axis I Wing Slot

|

DZ 22 W five axis |

DZ 25 S five axis |

DZ 28 S five axis |

|

|

DZ 25 P five axis |

DZ 28 P five axis |

| Max. travel X–Y–Z |

620 – 650 – 600 mm |

800 – 1,100 – 800 mm |

1,200 – 1,100 – 800 mm |

| Max. power |

61 kW |

61 kW |

61 kW |

| Spindle clearance DZ |

600 mm |

800 mm |

1,200 mm |

| Max. spindle speed |

20,000 RPM |

20,000 RPM |

20,000 RPM |

| Max. spindle torque |

200 Nm |

200 Nm |

200 Nm |

| Chip-to-chip time from |

3.1 s |

3.5 s |

3.5 s |

| Max. axis acceleration X–Y–Z |

10 – 10 – 17 m/s2 |

10 – 10 – 15 m/s2 |

10 – 10 – 15 m/s2 |

| Max. rapid traverse speeds X–Y–Z |

75 – 75 – 75 m/min |

120 – 75 – 75 m/min |

120 – 75 – 75 m/min |

| Max. number of tools |

2 x 77 |

2 x 60 |

2 x 60 |

| Tool holder |

HSK-A63/-A100/-T63 |

HSK-A63 |

HSK-A63 |

| Max. workpiece weight |

600 kg |

500 kg |

700 kg |

| Max. workpiece diameter |

599 mm |

799 mm |

1,200 mm |

| Max. workpiece height |

340 mm |

612 mm |

750 mm |

| Pallet size (for P variant) |

|

630 x 630 mm |

800 x 800 mm |

| Time to change pallet |

|

12 s |

12 s |